E8 Trader funding has been rated the best trader funding program. It leads the space in drawdown, value, product selection, scaling, and trading career potential.

Quick overview of E8 funding highlights before we dive deeper into the program details, products, pros, and cons

If you would like to follow along, click above to get a completely Free Trial. Get access to the E8 platform in minutes to explore the possibilities.

E8 Funding featured program highlights:

- Up to 20x in drawdown per fee paid

- Fee is refunded with first withdrawal

- Simple two Phase trader evaluation with 8% and 5% targets.

- ELEV8 Funded trader account with scaling and career opportunity

- Static drawdown – Overall account drawdown does not trail.

- Best cryptocurrency spreads amongst featured funded trader programs

Have a look at our review of all the E8 funded trader program features. We break down all the instruments and intricacies of the program.

In May 2022 E8 Funding rolled out some great program updates:

E8 Funding Program Overview

One time refundable fee program with diverse product selection. Simple rules. Refundable Fee. Scalable career opportunity.

Get funded in 1 trading day as long as profit targets are met. Have your first withdrawal in 8 days!

E8 Trading Product Review

Forex

E8 Trader funding is a Forex program at its core. They offer most major USD and EUR crosses. Huge selection of exotic crosses as well. Currency spreads for majors are great 0.6 pips in the screenshot above taken during the early US and late EU market session. Exotic currency crosses have higher spreads but are around industry best.

Index Products USA and EU

Index products require some further inspection to maximize chances of success and avoid a style of trading that might lower chances of funding.

E8 also offers other world indices but let’s look at USA tracking products to analyze how they compare to futures equivalents. Considering E8 will receive many customers from the futures space, it is important to understand instrument value.

Index products can be traded in increments smaller than even micro futures contracts and leverage allows to put on more size than equivalent virtual size trader evaluation programs. At E8 you are free to succeed trading your way.

US500 CFD tracking US500 – ES futures or SPY ETF traders will be disappointed here. Spread for SP500.e8 is usually bouncing around 12-13 ticks. Meaning that it would cost 2.5 ES point equivalent to market buy and instantly market sell a position. In futures markets that is 0.5 points in the calm market environment. SP500.e8 is not fit for scalping but is still fine for traders taking advantage of larger intraday moves or swing trading positions across a few days

US30.e8 or Tracking the Dow Index is very close to YM futures in the spread. 3.6 YM pt equivalent spread

US100.e8 – Tech Index tracking instrument prices much like NQ100 also has spread friendly to day traders and swing traders alike.

EU / WORLD Indexes – There are other world indexes available, log onto the trial to see if the tracing DAX or other world index CFD fits your trading needs.

Keep in mind that you are allowed to hold positions overnight, unlike most other trader funding programs, making paying slightly higher spreads worth it.

Stocks

The hottest US-listed stocks are available for trading at E8. Spreads are about double what they are with a regular online broker. Micro scalpers will be at disadvantage vs trading in online brokerage, but traders with a higher time frame view will be able to utilize these instruments that are driving the market.

Cryptocurrencies

Cryptocurrency day trading and swing trading are where E8 shines. Traders can trade cyrpto 7 days a week. All days are counted toward evaluation. So it is possible to sign up for evaluation on Saturday, complete phase 1 Saturday, complete phase 2 Sunday and be funded Monday all thanks to cyrpto currency trading availability.

Bitcoin and ETH lead the crypto space in trading. With E8 you can trade them with spread slightly better or equivalent to big boy exchanges like Coinbase. Please note that during moments of extreme volatility spreads expand at all exchanges. You can trade BTCUSD.e8 with 5x leverage at E8, meaning 10 BTC contracts in a 100k virtual evaluation account.

Increased spreads hurt traders in markets such as SP500.e8 – higher spread in very liquid markets is a disadvantage, which is why we advise looking at markets with tighter spreads. However in illiquid markets like cryptocurrencies, E8 not only offers better spreads, but you should also avoid huge slippage on larger orders. If a frisky trader decided to trade 20 BTC trade with market orders, theoretically should have much-improved performance vs equivalent trading with an illiquid broker.

Leveraged crypto trading is very risky, doing it in a trader evaluation environment takes a lot of risk of adverse events while providing top-tier leverage.

Commodities

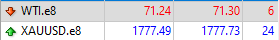

Crude Oil tracking WTI.e8 instrument allows traders to trade the most talked about commodity of the year. The spread above 5cents is too much for micro scalpers. However, for bigger intraday moves or swing traders, the instrument can still be utilized.

XAUUSD.e8 – Gold. Is great for scalpers and longer-term traders alike. In most market environments bid-ask spread in gold is in the 20-30 cent range.

Silver is also available for trading. Otherwise wild and very high margin markets can now be attempted to be tranquilized in a funded environment.

E8 Trader Freedom and Expert Advisor

E8 values trader freedom and allows for a variety of trading approaches. Manual execution by chart trading, manual execution on the DOM. You can use automated systems to trade all available markets.

If you would like to set up an AWS server hosting E8 MT4 with pine connector piping through automated trading system orders to your trading terminal on the cloud. You are free to do that too.

To enable traders to unlock their full potential E8 gets out of the way:

- No rules for when positions should be opened or closed. Hold trades during news, overnight, and even over the weekend.

- Trade 7 days a week

- Trade stocks, indexes, exotic currencies, commodities, crypto.

As long as you stay above the STATIC loss limit, you are allowed to reach the profit target however you wish.

News Trading with e8

It is perfectly within the rules to trade during the news. CFD products for crypto and indexes may have increased spreads during the times of high volatility. Much harder to control risk and costs more to get in and out of positions.

Here are the spreads minutes after the big FOMC announcement that saw NQ trade in 500 pt in 2 hrs following ($10,000 pt range per NQ contract for those unfamiliar)

Notable that cryptocurrencies so much increased spread up to 90 for BTC and 18 for ETH. Unless you have high conviction in directional trade, high price to pay for any kind of scalping.

Currencies remained pretty stable and the rest of products saw increased but acceptable spreads for day traders. Most traders should probably sit out high volatility news events despite trading them being well within E8 trader funding rules.

E8 Drawdown

As pointed out in the best funded program section, this is crucial to understand. STATIC Drawdown.

These are drawdowns of competitors:

- Always trailing – meaning drawdown figure never stops trailing. It goes up every time balance of the account makes a new high. In account with 2k profit target you could fail out for having a position be up unrealized $3,900 and close for $1,899 profit. Yes, that is actually a rule in many popular program. In E8 the static drawdown remains at Starting virtual balance -8%

- EOD trailing – much more generous than live trailing. But still massive disadvantage to the trader compared to E8 funding static drawdown.

Live funded drawdown

With E8 you can take out the profits above starting balance, all of them. And you will still have room to work with considering 8% static drawdown is still that. Competition in the trader funding space is likely to ask you to keep a cushion before withdrawing, all while trailing up the loss limit. A trader could easily have multiples of drawdown available vs the competition.

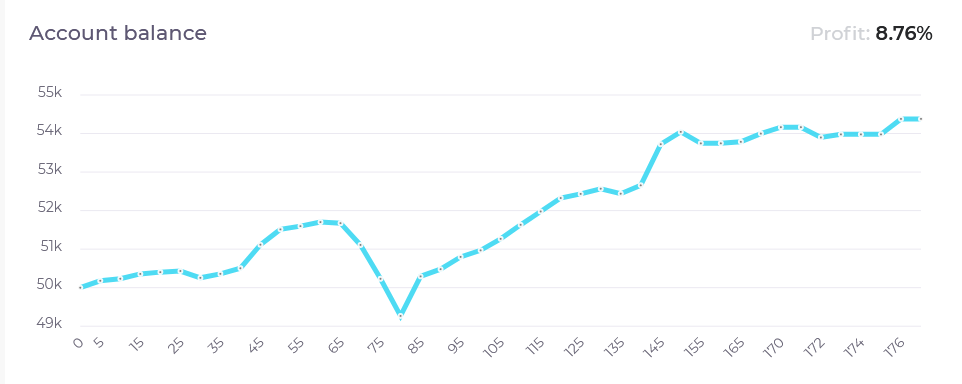

In the above two screenshots, you can see a passed phase 1 of trader evaluation that would have failed all competitor live and trailing drawdown programs. 50k account had over 3k drawdown from balance high to low, spanning 2 days. This would have failed all 50k virtual account size evaluations in the funding industry. Traders would have to either pay a reset fee or purchase a new evaluation to keep the funding dreams alive. Not only did the E8 evaluation not fail, but there was also still over 2K in drawdown available to the original virtual balance -8%. At the 52k balance mark, this trader has THREE TIMES more drawdown than he would at the competitor program.

Fee

Evaluation might seem high looking at just virtual account balance.

Firstly, the fee is refundable. Upon requesting the first withdrawal the fee is returned to the trader along with the payout amount.

Secondly, static drawdown allows significantly more opportunity for success than EOD and especially live drawdown programs. The extra cost is well justified.

It is also possible to scale live account size with ELEV8 and receive career offers, quite a perk for a refundable fee.

E8 Cons

Volume Analysis

Not as big of a deal for traders coming from CFD space. For traders using volume analysis to trade MT4 charting solution of e8 products will be a fairly big change.

Charting

Piggybacking on volume analysis point. MT4 is one of the world’s most popular platforms. They have many tools and scripts available for free and for purchase. However, Traders will likely find it beneficial to chart equivalent products on their favorite software and execute on E8 MT4.

Spreads

Some products have spreads that are too wide for scalping. ES / MES equivalent being 5-6 ticks wide is a bit much for some. That is a product that stands out the most, Crypto and Forex products have some of the best spreads around.

Profit Split

80% profit split, with 20% going to the firm. Well within good-to-great range. Many funded programs offer 40-70% profit splits, however, some firms around the industry offer 100% on the first chunk of profits before going into profit split. Have to dig deep to find some negatives for this program here.

Are you ready to take the trades while they take the risk?

ENROLL IN E8 EVALUATION

E8 Funding Tips

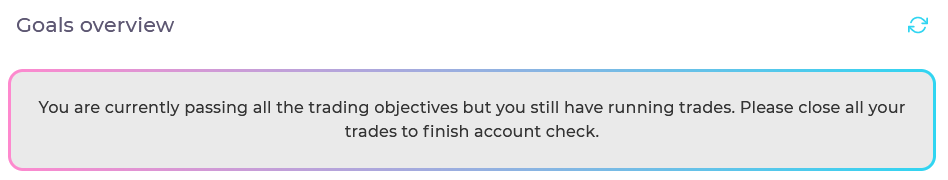

Be sure you are not popping champagne once balance hits the goal amount. Closeout all open positions and orders to advance the account for further step review.

If you are coming to E8 from the futures, stocks, or crypto world, make sure to familiarize yourself with contract specifications before placing trades. 1 contract of BTC is 1 coin, while for other instruments 1 contract is worth 1000 coins.

E8 MT4 Server Time. Server time for products in specifications is EET or Eastern European Time, currently 7 hour difference with EST time.

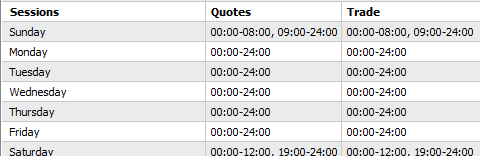

Mind the crypto Saturday break. It’s amazing to be able to trade cryptocurrencies 7 days a week. However, there is a 7-hour break on Saturdays and 1-hour break on Mondays when the CFD markets are closed for charting and execution. It is fine to hold open positions during that period. Just be mindful to not get stuck in big positions in the often-volatile cryptocurrency market.

E8 Crypto Trading in a volatile environment is not consistent across coins and tokens. During periods of high volatility, Bitcoin spreads wide fairly fast. Ethereum and Litecoin spread remain steady during high volatility events. High volatility scalpers might find BTC spreads widen out too much.