OneUp Trader is a gateway for traders to join prop firms via a quick 15-day trader evaluation. Complete trader evaluation objectives and get guaranteed placement with a proprietary firm to trader futures.

Prop Firm Partners offer very quick payouts that set them apart from the rest. Competitors might make you wait to withdraw for a month, while with OneUp trader funding partners you can get paid within 24 hours of the request, multiple times a week.

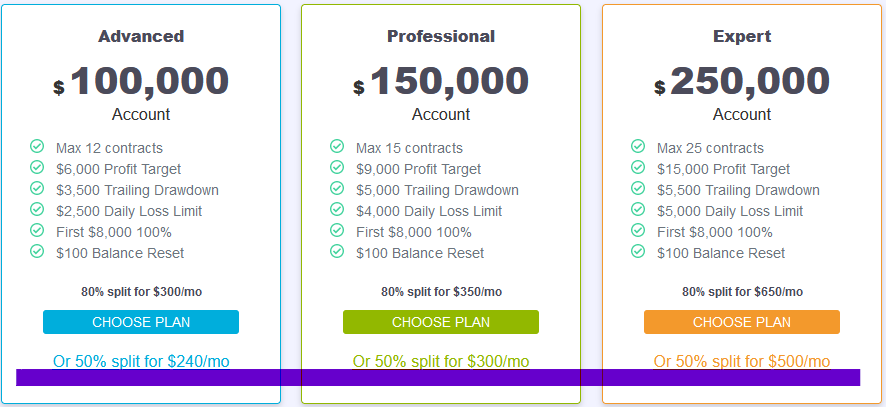

For those familiar with funded trader programs and eager to get started, let’s have a look at their top 1-step trade evaluations

OneUp Trader Discount Code

OneUp Discount Code: KEX3X2A

Discount Code gets traders 15% off all evaluation accounts. In the upcoming OneUp funded trader program review and comparisons, the price will feature the 15% off sale price.

One Up Trader Evaluations

after KEX3X2A 15% Off code

after KEX3X2A 15% Off code

after KEX3X2A 15% Off code

The above-listed funded trader programs feature a 100% profit split on the first $8000 of profits to the trader, and 80% thereafter.

Traders also have an option of saving on evaluation costs by selecting a 50% profit split option. In that scenario, traders will receive 100% on the first $5000 of profits and a 50% split on all following profits from trading with a partner prop firm.

How you can save 25% and 15% on trader funding costs? Simple:

- Go to One Up Trader

- Select “or 50% profit split” option under funded trader plan of your choice, for 25% savings

- Enter Discount Code KEX3X2A at checkout for additional 15% savings

- Complete checkout

Ninjatrader License and Data Feed should be emailed to the trader shortly. Trader journey to trading for a prop firm begins.

OneUp Trader Evaluation Process Review

We look at all aspects of trader evaluation to see how it stacks up in the funded trader industry for its product niche and drawdown type. The Review Process is described in detail here. Let see go through OneUp evaluation parameters:

Funded Propgram Cost:

💳 Programs start at $89, for a $25,000 virtual account and 50% profit split. The initial cost is a bit higher than other programs in trailing drawdown niche like Apex Trading or LeeLoo Funding. The slightly higher cost is quickly made up for with the lack of funded trader data fees in prop firm partnership and much easier access to profits in a live account.

Maximum Position

❇️ Traders have access to plenty of leverage from 3 to 25 mini contracts. If you have been following the markets lately, we have had some moves of $16,000 per one contract in the NQ futures. Having access to trade 6 futures contracts in the account with $2,500 is perhaps too much leverage. Nice to have the ability to trade bigger as the account grows.

Drawdown

OneUp Trader is a training drawdown program. See our Drawdown Explained section to compare drawdown types. Here is a great video explanation for their drawdown calculation process:

In the trailing drawdown niche, this is the most favorable condition. Max loss level stops trailing after reaching the initial virtual balance. Some competitors will have the drawdown trail past the initial balance. Small inconvenience considering the value offered.

Daily Loss Limit

We give typically do not like to see too many rules that can cause traders to fail out of the evaluation and have to pay a funded program reset fee or have to start all over again.

In the case of OneUp daily loss limit helps the trader not to blow out the account in a single day without punishment. Traders can continue trading the next day. Other programs will gladly have you violate the daily drawdown level to collect more fees.

Profit Target

Amount traders are required to profit to qualify for funding with a prop firm. Profit targets are in line with the rest of single-step programs and are a big improvement over two-phase evaluation programs.

OneUp has a deeper drawdown, so its Profit Target to Drawdown ratio is elite for all equivalent programs.

Trader Consisistency Requirement

To avoid handing over funding to one lucky trader wonders in a single-step funded trader program, OneUp has implemented a consistency requirement:

Traders must have any 3 trading days’ net profits total summed up to equal 80% or more of the largest day’s net profit.

Consistency rules explained:

Being Live Funded Trader with OneUp Prop Firm Partners

OneUp Prop Firm partners have some of the best conditions in the funded program industry, starting with

No Set Up Costs or Data Fees

Funded traders are not required to pay any initiation costs.

Rithmic RTrader Pro is provided Free of charge. If you have your software you can connect a Rithmic data feed to it. If you would like to use other software you will need to cover those costs on your own.

Partner prop firm covers the exchange fees. This is a massive advantage. Other programs in the niche ask you to pay for all the data that can add up to over $400/month.

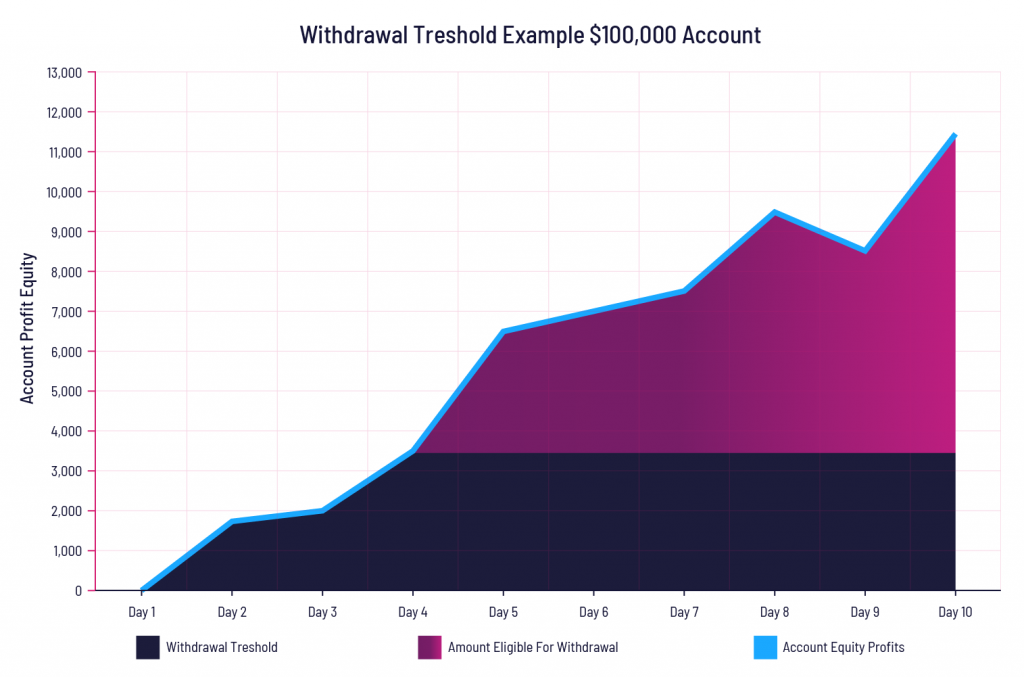

Live Trader Withdrawals

To maximize the chance of a successful and profitable trading career, traders are asked to keep some profits in the account and only withdraw profits above what they call Withdrawal Threshold.

$25,000 Account > Withdrawal Profit Threshold $1,500

$50,000 Account > Withdrawal Profit Threshold $2,500

$150,000 Account > Withdrawal Profit Threshold $5,000

Traders in the 80% profit split program get 100% of the first $8,000 in profit and 80% thereafter.

Traders in the 50% profit split program get 100% of the first $5,000 in profit and 50% thereafter.

Fast Prop Firm Payouts

Same Day Withdrawals! That’s right, no need to wait for the last Monday of the month after You have traded 50 days just to get one withdrawal that is limited to a small amount. Make profit, withdraw, receive within 24 hours.

We have traders on our team who confirmed trading during the day, requesting withdrawal during lunch, and having the money in the bank account by dinner.

Free Trial

If you are not ready to commit to buying an evaluation. You are welcome to have live data and the NinjaTrader platform free for 14 days. Set up your charts and get used to the instruments via OneUp Trader Free Trial

Battle of the Funded Programs

It is very difficult for traders new to the funding space to sift through the details and faqs of the programs to see which one is most trader-friendly and has the best conditions for success.

Without further delay, let’s have a battle between top names in the trailing drawdown niche

OneUp Trader vs Apex vs LeeLoo Trader Funding

An in-depth look at all aspects of funded trader program competitors and surprises and fees you might encounter along the way. We feature all these programs as they all have the right place for different traders. Especially during very generous funded trader deals.