Trading Drawdown is the difference between the highest account capital and the lowest subsequent account balance low. Drawdown is a key performance metric for quantifying system and trader performance.

Measuring historical risk is a very important factor in gauging prospective traders. This is why it is one of the key components of funded trader program rules and evaluations metrics.

Sorting through all the drawdown rules can be confusing, a program with a $3000 drawdown is not necessarily better than the program with a $2500 drawdown. Confusing indeed. Let’s break it all down.

Drawdown Overview

Drawdown or maximum account decline rules are grouped into the following categories:

- Duration

- Daily

- Weekly

- Overall

- Drawdown calculation type

- Live Trailing

- EOD Trailing

- Static

Drawdown Period

Funded Programs are great for new traders to gain market experience with a chance of funding without risking their capital in high leveraged markets. They are also very useful to teach traders discipline and risk management.

New traders will benefit from learning not to take losses that are too large for their account size. Managing risk and being able to trade another day is very important.

Experience traders or traders with larger account swings might benefit from looking at programs with fewer drawdown rules and drawdown sizes that will not hinder the execution of the desired trading system.

Daily Maximum Loss

Level of negative profit & loss to stay above for the day.

If your program has a $1,000 daily loss limit. An account with starting balance of $50,000 would not be allowed to touch $49,000 that day.

Futures programs most often count the Day as a period from futures open 6 pm to RTH market close. Please be sure to check your prop firm rules when they ask you to be flat. Some programs it is 4:00 pm EST, some allow holding up until the last second of 4:15 pm EST. 4

Forex and cryptocurrency program participants will need to pay attention to the clock to which the programs adhere. Some use CET (Central European Time), others use local time like EST.

Be sure to familiarize yourself with the daily drawdown exact parameters to not cost yourself a chance of funding because of misunderstanding.

Weekly Loss Limit

Less common in funded programs. Few programs ask you to adhere to a weekly loss limit.

Stay above the weekly maximum loss line to stay eligible for funding. Be sure to know drawdown style if it is trailing, EOD, or static.

Most programs will provide a tracking dashboard with a loss limit to let you know the level to adhere to.

Overall or Total Maximum Drawdown

Total Maximum loss allowed in the account.

For example, $50,000 accounts with a $2,500 loss limit can never touch $47,500 to be available to advance to further evaluation steps or to receive funding.

Drawdown Type Breakdown

The drawdown type often separates the programs more than the drawdown amounts in our funded trader program rankings. Once we are done with the breakdown you will understand why, lets rank the available drawdown types.

1 – Static Drawdown

This is by far the best and most trader-friendly drawdown type that exists in funded trader evaluations, programs, and prop firm environments.

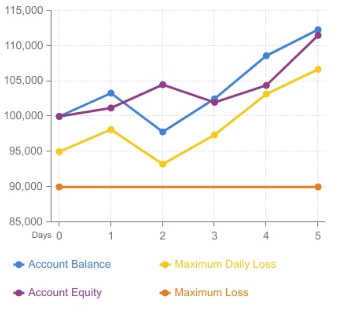

If starting account balance is $100,000 and the maximum loss limit is $90,000. The static account loss limit will never trail up. If traders make $2 or $20,000 on the trade, will always have room to trail down to just above $90,000. A huge advantage over any kind of trailing drawdown program.

Keep in mind that static drawdown programs often have a daily loss limit rule. The daily loss will reset every day, but the main account maximum loss level will remain at the same amount.

Helps traders develop discipline and stop when things aren’t trading the way system predicts them to and helps avoid big collapses. Also doesn’t punish traders for making a profit early and having a drawdown.

Static account loss limit programs are a better value at an even higher price than some alternatives. The ranking system takes into consideration drawdown type heavily. Static drawdown programs will usually cost more than their peers of lesser drawdown types. If drawdown per dollar is about the same as lesser loss calculation account types, go with static. We will of course help you sort through ALL pros and cons of funded trader programs using full funded trader program review criteria.

2 – EOD – END OF DAY Trailing Drawdown

EOD or End of Day trailing drawdown is usually the best option in futures funded trader programs. Unfortunately, there are no programs we review that offer static drawdown.

Let’s look at an example of a $50,000 starting virtual balance account with a $2,000 drawdown.

Trader’s open and closed P&L has to stay above the maximum loss limit. At the end of the day, if a new closing balance high is made, the trailing max drawdown adjusts up by the profit amount. Max drawdown stops trailing at the initial balance amount.

Top futures trader programs like Gauntlet by Earn2Trade feature EOD drawdown. If can be purchased at an equal or better price for the same parameters as live trailing drawdown peers, EOD programs are much better valued.

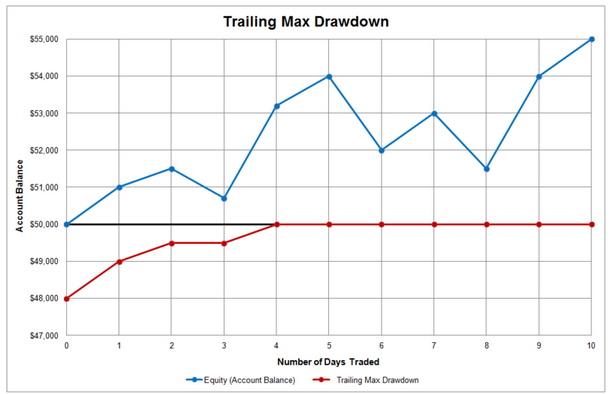

3 – Live Trailing Drawdown

You will see this name “Limited Trailing Account Balance”, Trailing Maximum Loss, and similar names.

The maximum loss level on the account always trails up the highest account balance on the account by the maximum loss amount. That includes intra-trade equity.

Two live trailing account characteristics to look for:

- Stops Trailing at initial account balance. Meaning if a trader reaches profit greater to or equal to max drawdown. Then account trailing drawdown doesn’t trail anymore. This type of evaluations might require some initial strategy adjustments to avoid deeper draw downs from account high. But once drawdown stops trailing trader freedom is unlocked.

- Never Stops Trailing. These evaluations are lowest rated and have to be offered at great discounts to be considered. Traders will have to be very risk conscious throughout the whole evaluation. In these evaluations you can actually fail out of evaluation by hitting trailing limit while being overall profitable. Fortunately these types of evaluations only apply such pesky rule to trader exam and drawdown stops trailing during the live funded account environment.

Programs like Apex Trader Funding are rated very highly during their generous sales despite the live trailing drawdown. The available opportunity is just too good in $ per drawdown terms to not adjust to the live trailing drawdown during evaluations.

Prop Firm Loss Limit Type Summary

Trader funding programs that we currently feature are sorted by account loss type:

| Prop Firm | Products | Drawdown |

| FTMO | Forex, CFDs for Indexes, Commodities, Stocks, and Cryptocurrencies | – Static Total Account Drawdown – Static Daily Max Loss Limit |

| E8 | Forex, CFDs for Indexes, Commodities, Stocks, and Cryptocurrencies | – Static Total Account Drawdown – Daily Max Loss Limit |

| Gauntlet Mini | Futures | – EOD Trailing Total Drawdown – Static Daily Max Loss |

| Apex Funding | Futures | – Live Always Trailing during the evaluation – Live Trailing in the funded account, stop trailing at initial balance |

| LeeLoo Trading | Futures | – Live Always Trailing during the evaluation – Live Trailing in the funded account, stop trailing at initial balance |

| TopStep Trader | Futures | – EOD Drawdown in Combine (Evaluations) – Daily and Weekly Static drawdowns in Step2 – Live trailing drawdown in live funded (stop trailing at starting balance) |

Hopefully, this adds clarity to the confusing world of trailing losses in a funded trader environment. If you have any questions please leave a comment and we will expand further on any questions you might have.

Trade well and good luck!